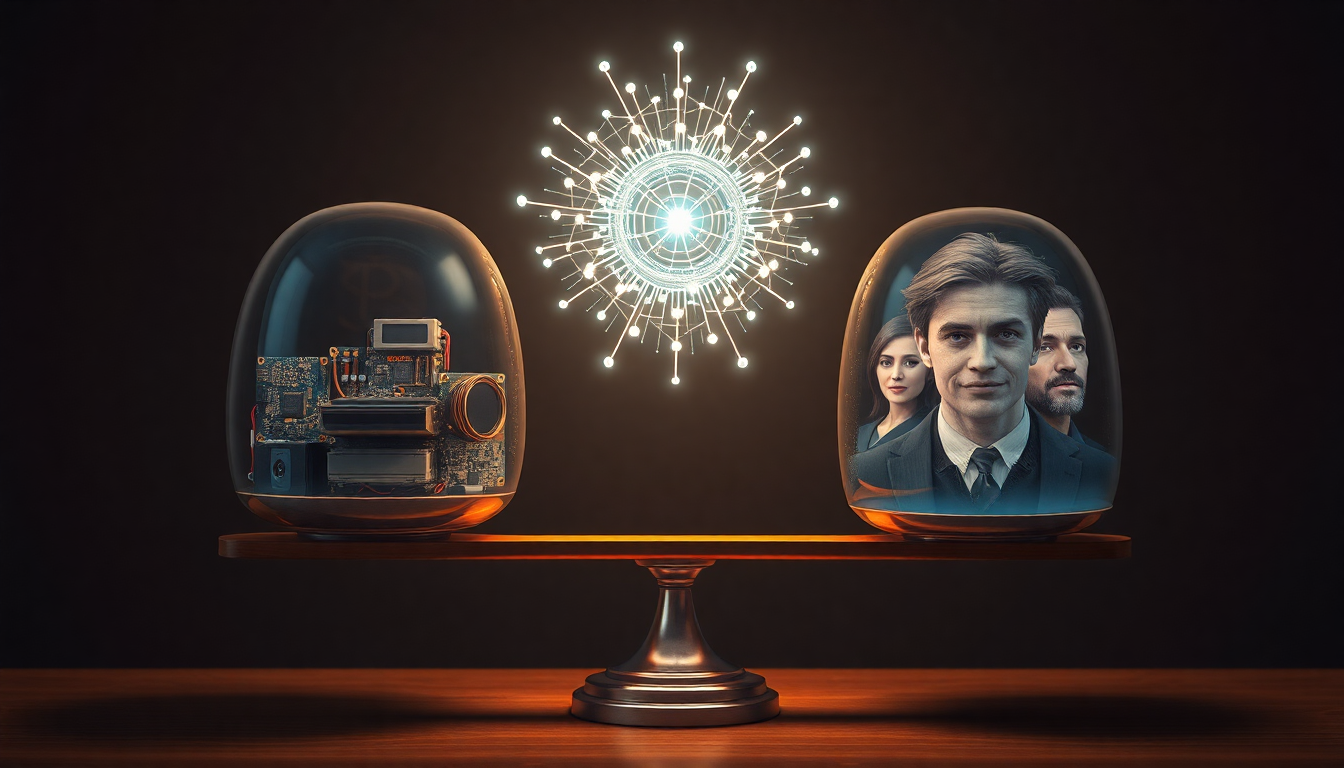

Strategic Token Allocation: Balancing Incentives for Tech Companies and Founders

In the rapidly evolving world of blockchain and cryptocurrencies, the strategic allocation of tokens plays a crucial role in determining the long-term success of a project. This article explores the intricate balance between allocating tokens to core tech companies and founders, focusing on how to align incentives, ensure long-term commitment, and maintain transparent governance for sustainable network growth.

Introduction

The distribution of tokens in a blockchain project is akin to dividing the shares of a company. It's a critical decision that can significantly impact the project's trajectory, stakeholder motivation, and overall ecosystem health. As we delve into this topic, we'll examine the key considerations for token allocation, exploring strategies that can foster a thriving, sustainable network while rewarding those who build and maintain it.

Core Tech Company Token Allocation

Ensuring Long-term Commitment

Allocating tokens to the core tech company is crucial for ensuring its long-term commitment to the project. This strategy is particularly effective when the company is expected to play an ongoing role in development and maintenance.

For instance, Ethereum allocated a significant portion of its initial token supply to the Ethereum Foundation, which continues to drive core protocol development and ecosystem growth. This allocation has ensured that the foundation has the resources to support the network's long-term development.

Operational Funding and Employee Incentives

Tokens allocated to the core tech company can serve as a vital source of operational funding. This allocation can cover ongoing development costs, marketing expenses, and even serve as an attractive incentive for recruiting and retaining top talent.

Consider the case of Polkadot, where a substantial token allocation was made to the Web3 Foundation and Parity Technologies. This allocation has enabled these entities to fund continuous development, research, and ecosystem growth initiatives, contributing significantly to Polkadot's rapid expansion and technological advancements.

Founder Token Allocation

Personal Incentive and Commitment

Direct token allocation to founders serves as a powerful personal incentive, rewarding them for their initial vision, risk-taking, and effort in launching the project. This approach ensures that founders have a substantial stake in the network's success, aligning their interests with its long-term growth.

The story of Binance and its founder, Changpeng Zhao (CZ), illustrates this point well. CZ's significant token holdings in BNB have tied his personal success to the platform's growth, motivating him to continually innovate and expand the Binance ecosystem.

Vesting and Lock-up Periods

To prevent founders from dumping tokens and potentially destabilizing the network, it's crucial to implement vesting schedules and lock-up periods. These mechanisms ensure that founders remain committed to the project's long-term success and prevent sudden market disruptions.

For example, when Filecoin launched, it implemented a six-year vesting schedule for team and founder allocations, with tokens gradually unlocking over time. This approach helped maintain investor confidence and ensured the team's long-term commitment to the project.

Balanced Approach: Combining Company and Founder Allocations

Diversification of Incentives

A balanced approach that allocates tokens to both the core tech company and individual founders can create a robust incentive structure. This strategy ensures that both corporate and personal interests are aligned with the network's success, fostering a more resilient ecosystem.

Cosmos provides an excellent example of this balanced approach. The project allocated tokens to both the Interchain Foundation and individual founders, creating a diverse set of stakeholders invested in the network's success. This strategy has contributed to Cosmos' vibrant ecosystem and continuous innovation.

Transparency and Governance

Regardless of the chosen allocation strategy, maintaining transparency throughout the process is paramount. Clear communication about token distribution, vesting schedules, and usage of funds builds trust within the community and attracts long-term supporters.

Implementing a decentralized governance model, such as a DAO (Decentralized Autonomous Organization), can further enhance transparency and community involvement. For instance, MakerDAO's governance token (MKR) distribution allows stakeholders to participate in key decisions, ensuring that the interests of token holders, the core team, and the broader community remain aligned.

Conclusion

Strategic token allocation is a delicate balancing act that can significantly influence a blockchain project's trajectory. By carefully considering allocations to both the core tech company and individual founders, projects can create a robust incentive structure that promotes long-term commitment, aligns interests, and fosters sustainable growth.

As the blockchain space continues to evolve, transparent and well-structured token allocations will play an increasingly important role in differentiating successful projects. By learning from the experiences of established networks and adapting these lessons to their unique contexts, emerging projects can lay the foundation for thriving, resilient ecosystems that stand the test of time.