Strategic Token Distribution: A Blueprint for Sustainable Blockchain Ecosystems

In the rapidly evolving world of blockchain technology, crafting a well-balanced token distribution strategy is crucial for the long-term success and sustainability of any project. This comprehensive guide explores the intricacies of token allocation, emphasizing the importance of aligning incentives and fostering long-term growth. By delving into effective methods of distributing tokens among various stakeholders, we'll uncover the keys to ensuring operational sustainability and robust community engagement.

The Foundation of Token Distribution

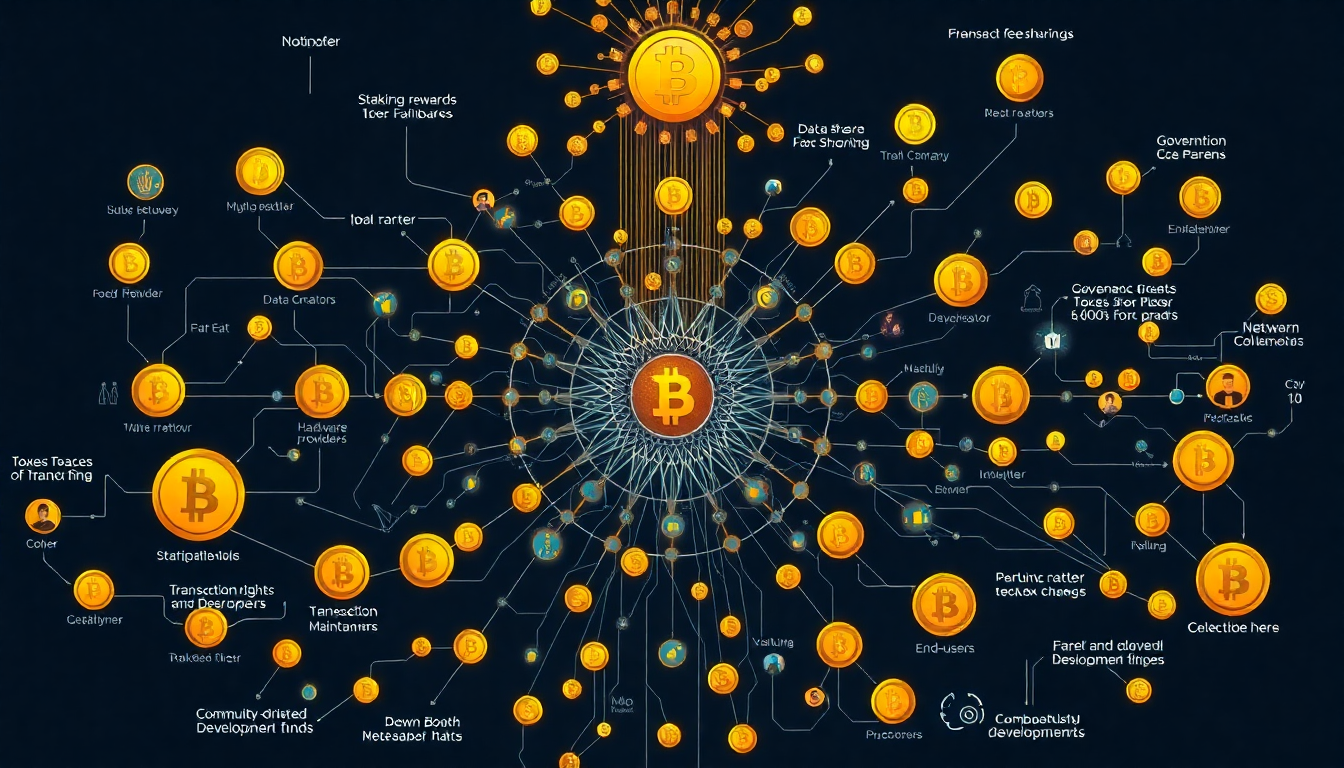

Understanding the Stakeholders

At the heart of any successful blockchain project lies a diverse ecosystem of stakeholders, each playing a vital role in the network's growth and sustainability. These typically include:

- Liquidity providers

- Hardware providers

- Data and model creators

- Network maintainers

- Developers

- End-users

Recognizing the unique contributions of each group is essential in designing a token distribution strategy that not only rewards participation but also aligns long-term interests with the project's success.

Balancing Initial and Long-term Distribution

A well-structured token distribution plan must strike a delicate balance between initial allocation and long-term sustainability. This involves:

- Determining the optimal percentage for the initial token sale or distribution event

- Establishing a vesting schedule for team and advisor tokens

- Creating reserve funds for future development and community initiatives

- Implementing mechanisms for ongoing token generation or release

For example, the Ethereum project initially distributed about 72% of its total supply during its presale, with the remainder allocated to the Ethereum Foundation and early contributors. This approach provided immediate liquidity while ensuring resources for long-term development.

Incentive Alignment Strategies

Reward Mechanisms for Network Participants

Designing effective reward mechanisms is crucial for incentivizing participation and contribution to the network. Consider the following approaches:

- Staking Rewards: Encourage token holders to stake their assets by offering attractive annual percentage yields (APY).

- Transaction Fee Sharing: Distribute a portion of network fees to active participants.

- Governance Rights: Grant voting power proportional to token holdings or network contribution.

- Gamification: Implement achievement-based rewards to boost engagement.

The Cosmos network, for instance, uses a combination of staking rewards and transaction fee distribution to incentivize validators and delegators, promoting network security and active participation.

Vesting and Lock-up Periods

Implementing vesting schedules and lock-up periods for certain token allocations can help align long-term interests and prevent market disruptions. Key considerations include:

- Gradual release of team and advisor tokens over several years

- Cliff periods before initial token releases

- Performance-based vesting tied to project milestones

Polkadot's approach to vesting is noteworthy, with a portion of tokens subject to a two-year vesting period, ensuring sustained commitment from early backers and the core team.

Fostering Community Engagement and Governance

Community-Driven Development Funds

Allocating tokens to community-driven development funds can significantly boost ecosystem growth and innovation. These funds can:

- Support third-party developers building on the platform

- Finance community-proposed improvements or features

- Incentivize the creation of educational content and tools

Uniswap's governance token (UNI) distribution included a substantial community treasury, empowering token holders to collectively decide on the allocation of resources for ecosystem development.

Decentralized Governance Models

Implementing a decentralized governance model is crucial for long-term sustainability and community alignment. Key aspects to consider include:

- Token-weighted voting systems

- Proposal submission and review processes

- Execution of approved changes through smart contracts

The Maker protocol's governance model, utilizing MKR tokens for voting on key decisions, serves as an excellent example of decentralized governance in action.

Ensuring Long-term Sustainability

Adaptive Token Supply Mechanisms

To maintain economic stability and incentivize ongoing participation, consider implementing adaptive token supply mechanisms such as:

- Inflation schedules that adjust based on network growth and usage

- Burn mechanisms tied to transaction volume or network fees

- Rebasing protocols that adjust token supply to maintain price stability

Algorand's tokenomics model, featuring a transparent and predetermined release schedule combined with a unique rewards distribution mechanism, demonstrates how adaptive supply can be effectively implemented.

Ecosystem Development and Partnerships

Allocating tokens for ecosystem development and strategic partnerships can drive long-term growth and adoption. This may involve:

- Grants programs for developers and researchers

- Token-based incentives for integration with other protocols

- Collaborative ventures with established projects or enterprises

Chainlink's successful growth can be partially attributed to its strategic use of tokens to incentivize node operators and form partnerships with data providers, enhancing the network's utility and adoption.

Conclusion

Crafting a strategic token distribution plan is a complex but crucial task for any blockchain project aiming for long-term success. By carefully considering the needs and contributions of various stakeholders, implementing robust incentive mechanisms, and fostering community engagement and governance, projects can create a sustainable ecosystem that aligns interests and drives continuous growth. As the blockchain space evolves, adaptability in tokenomics will remain key to navigating challenges and seizing new opportunities. By following the blueprint outlined in this guide, projects can lay a strong foundation for a thriving, sustainable blockchain ecosystem that stands the test of time.